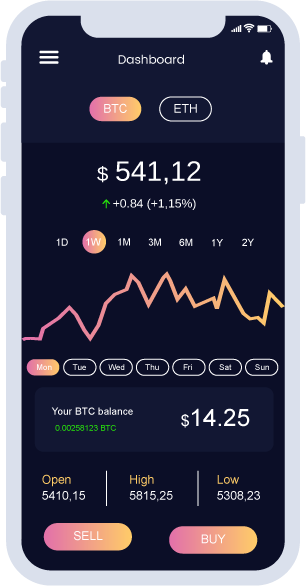

DANF is a utility token to be use on Danfund Platform: A Blockchain Based Crowdfunding Platform

Supported Coin :Download Whitepaper

Danfund is the blockchain-based crowdfunding platform, Powered by the Cryptocurrency DANF Token and using the modern technology e.g Machine Learning and Artificial Intelligence will have a big impact on the user experience overall. We are moving from the overhead of using traditional payment methods to the blockchain revolution, making it more easy and reliable for people to use the platform.

Download Now